For many organizations, the big question around Managed Detection and Response (MDR) is not whether they want it (they do), but how to fund it.

MDR is typically a new weapon in an organization’s cyber defense arsenal – and a new funding ask. While some organizations can leverage their contingency allocations, not every IT budget has sufficient stretch to cover an MDR investment in the short term.

Fortunately, other options are available for organizations that are struggling to fund MDR through their existing cybersecurity budget. One solution is to use MDR to unlock savings on cyber insurance premiums that can be redirected to fund the service itself.

Re-balance your cyber risk reduction spend

MDR and cyber insurance are two complementary ways to manage cyber risk. With MDR you reduce your risk by elevating your defenses; with insurance you transfer the risk to a third-party.

Insurers recognize the superior risk reduction that MDR delivers, rewarding organizations with lower premiums and better terms. Indeed, one leading carrier told me that MDR users are their “tier 1 customers” due to their lower risk of experiencing a high-cost incident. All things being equal, many insurers prefer to cover MDR users and price their policies accordingly.

This recognition enables organizations to re-balance their cyber risk reduction spend; with less funding needed for insurance, budget can be re-directed to fund MDR. The result is a win-win, with organizations benefiting from both better cyber defenses and lower cost coverage.

Unlock material insurance savings with Sophos MDR

Sophos MDR is the world’s most trusted MDR service, protecting more organizations than any other provider. With consistent top-ratings from customers and analysts alike, businesses of all sizes are choosing to elevate and extend their defenses with Sophos.

Many cyber insurers recognize the exceptional risk reduction that Sophos MDR delivers, rewarding customers with discounted insurance premiums and easier access to coverage.

Additionally, Sophos’ insurance partners provide exclusive insurance plans and material discounts for Sophos MDR usage. Application varies on a country-by-country basis in line with local insurance regulations, including:

- UNITED STATES: Sophos MDR customers automatically qualify for Cysurance’s flat-rate insurance plans that provide discounted coverage. Learn more.

- AUSTRALIA: Cysurance offers 33% discount for Sophos MDR users (plus 18-21% for users of Sophos Endpoint). Learn more.

- UK: Cowbell provides 12% discount for Sophos MDR users (plus 8% discount for those using Sophos XDR). Learn more.

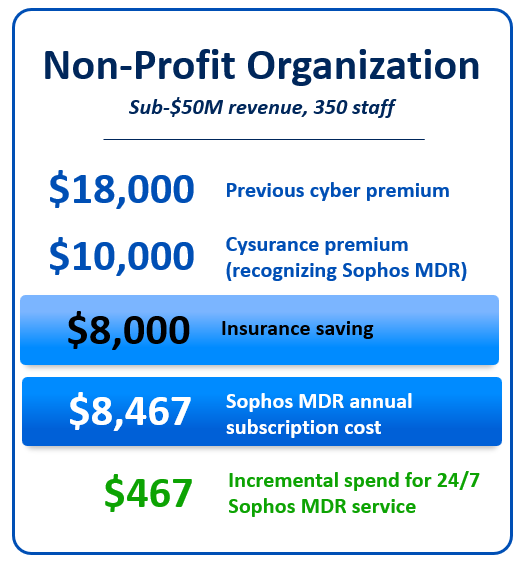

Case study

In one recent example, a Sophos MDR user based in North Carolina in the U.S. reduced their insurance premium by $8,000 with Cysurance. With their annual Sophos MDR subscription coming in at $8,467, the insurance saving meant they could enjoy 24/7 expert-led threat detection and response for an incremental spend of just $467.

These savings are not limited to smaller organizations. Following a major ransomware incident, a well-known national UK retailer was quoted insurance premiums in the range of £1 million. The retailer turned to Sophos MDR to reduce the risk of experiencing another cyber incident. In light of this investment, Cowbell was able to offer a six-digit reduction in their coverage costs – thereby releasing budget for investments in improving their cyber defenses.

While every organization will have different insurance and security needs, these examples illustrate the considerable potential for investment in cyber defenses to unlock insurance savings and reduce the overall total cost of ownership (TCO) of cyber risk reduction.

Switch to a risk-focused approach

Cyber defenses and cyber insurance are two sides of the same coin, with both enabling organizations to manage and reduce their cyber risk. However, traditional organizational structures often reinforce a silo-ed approach, with budgets and activities considered in isolation.

The key to enabling your organization to take advantage of the interplay between cyber insurance and cyber defenses is to change the conversation. By switching to a risk-led approach you can bring together all your resources – human and financial – under a shared goal, facilitating delivery of superior business outcomes.

Explore Sophos MDR

Sophos MDR already enables over 23,000 organizations to achieve superior cybersecurity outcomes. Having a team of expert analysts monitoring for and responding to cyberthreats 24/7 reduces the risk of a business-impacting cyber incident and frees-up IT/cybersecurity teams to focus on more strategic initiatives. Plus, with 91% of ransomware attacks starting outside traditional business hours, using a specialist MDR service allows everyone to sleep better at night.

Customers, analysts and partners alike recognize the exceptional risk reduction Sophos MDR delivers, and accolades include:

- Gartner Peer Insights Customers’ Choice for MDR

- Leader in the G2 Summer 2024 Reports

- Leader in the 2024 IDC MarketScape for Worldwide MDR

- Leader in Frost & Sullivan’s 2024 Frost Radar™ for Global MDR

- Leader (for the 14th consecutive time) in the Gartner® Magic Quadrant™ for Endpoint Protection Platforms

To learn more and explore how Sophos MDR could benefit your organization, visit our website or speak to your Sophos partner or security specialist.

About the author

Raja Patel is Chief Product Officer at Sophos. With a passion for developing world class products and teams, and broad leadership experience, Raja drives Sophos’ innovative product strategy and roadmap to deliver better security outcomes for customers around the globe. Prior to Sophos Raja held senior leadership positions at Akamai, McAfee, Intel and Cisco.